Mortgage Brokerage: Expert Home Loan Solutions Australia

It is not simply a case of getting the lowest rates when you search for mortgage brokerage assistance; rather, what you want is a hassle-free and transparent experience through the home loan process. As a first-time home buyer, a person in need of refinancing and mortgage loans, and someone who thinks about investment property mortgages, the Mortgage Brokerage provides the individually tailored solutions that can improve your financial life considerably.

In this complete guide, we are going to take you through how a Mortgage Brokerage age service can assist you with various home loan services, including investment services, being a first-time buyer, and many more. We will also explore the different types of loans and what defines them all to help you pick the one that best meets your financial requirements.

What is Mortgage Brokerage and How Can it be of Competence to You?

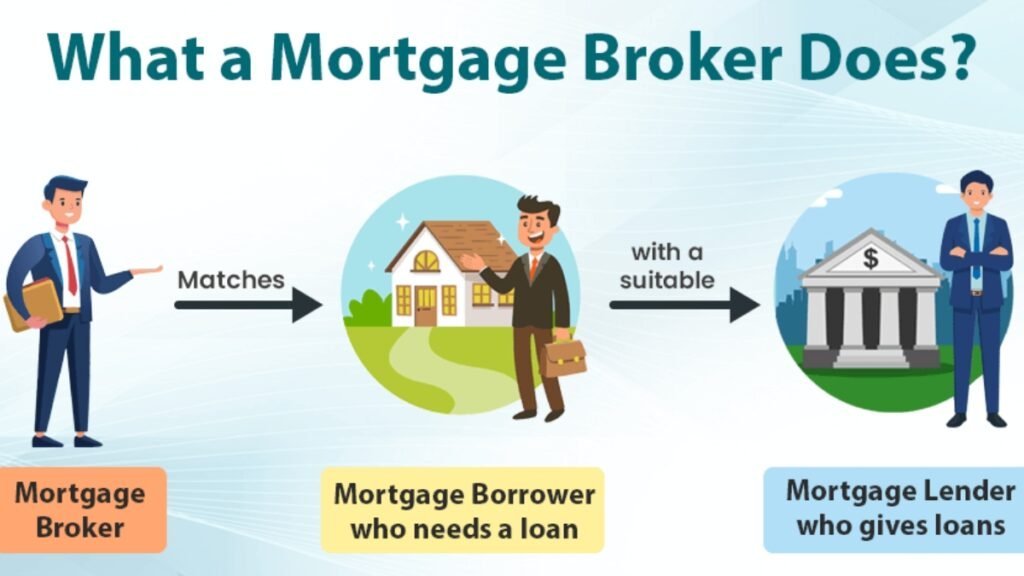

A mortgage brokerage is a middleman who links you with the lenders. Brokers strive to find you the best deals possible on a loan and thus can speed up the process and also make it quite cost-effective. Given the number of mortgage solutions in the market today, it becomes hard to move in the market without professional help. A mortgage broker streamlines the process of purchasing a home through a loan by eliminating the complexity of the situation.

In Australia, brokerage service is not just about loan comparisons, it is personalized financial advice, expertise in the market, and bargaining power to achieve the best terms, rates on loans. As a first-time homebuyer, refinancing, or in need of a mortgage loan, a broker would guide you and assist you in making informed decisions.

Brokerage Mortgage Solutions: Solutions to Every Need

A mortgage brokerage service is not universal; rather, it is flexible according to the needs of a client. A broker can assist you in finding the right loan in case you want to buy a home as an investment or if you need assistance as a first-time homebuyer. The following are some of the general services offered by mortgage brokers:

Home Loan Solutions: Getting the Groove that Suits Your Dream House

Mortgage brokerage approaches you to ensure that you have the best deals on home loans that apply to your financial position. The brokers look in detail to ensure that you are not getting any deal that may not suit your future financial accommodation by looking at issues of fixed-rate mortgages and variable-rate mortgages.

REGISTER NOW:

- Fixed-Rate Mortgages: Provide security in terms of a predetermined interest rate that has to be paid throughout the duration of the loan.

- Variable-rate mortgages: They are variable interest rates that depend on the effect the environment has on interest rates.

Refinancing Alternatives: The Magic of Lower Rates

When you are in the process of paying off a house mortgage and are wishing to make your payments lower or want to borrow the equity in the house, a mortgage brokerage can get you started on researching refinancing. Refinancing enables you to enjoy lower interest or switch your lending conditions, which could result in you saving thousands of dollars throughout the lending period.

First Time Home Buyer Money: Can Give You a Start

It is easy to get intimidated by the property market as a first-time homebuyer. A mortgage brokerage can provide professional assistance every step of the way, including determining what type of loans a person is qualified to receive or how to attain the right funding. Homebuyer schemes: First-time buyer help can cover low-deposit loans, government schemes, and personal financial advice.

Investment Loans: Expand Your Empire

For more experienced investors or intenders wishing to invest in the property market, an investment property mortgage can offer the finance you need to maximize your property portfolio. With the help of brokers, the lenders can assist in contracting loans specifically intended to procure investment real estate properties, and they will have the result of giving you the best-promised returns there possibly are.

Understanding Loans with the Mortgage Brokerage Services

There are a top number of loan types that individuals may become confused when it comes to loan types. These are the major loan types offered by mortgage brokers in more detail.

Low-Doc Home Loans: Home Buyers Self-Employed

Self-employed people typically have issues with supplying the traditional mortgage papers. Low-doc home loans are meant to be a means for the person to qualify to buy a home, yet might not include the usual paperwork to determine their income. It is possible to get a low-doc home loan with the help of a mortgage brokerage that will consider your financial circumstances.

Debt Consolidation Loans: Streamline Your Life

When you are faced with a number of debts, a debt consolidation loan will assist in consolidating all your debts into a single amount of monthly payments and, in most cases, more favorable payment terms. Mortgage brokers assist you in researching the debt consolidation loans avenues to make sure that you are now paying credit through a charge that is more affordable and often charged at a cheaper rate.

Bridging Finance: Short-term loan Finance

Bridging finance can prove to be a savior to those who require the funds at the earliest, without having to sell off their already owned property. Such of loan will enable you to purchase a new house even when you are yet to sell your old one. The rates of bridging finance may involve various terms, and there is a good way of making the process as painless as possible, as a professional mortgage brokerage was set to instruct you through the process.

Important Factors to Note when Dealing with a Mortgage Brokerage

Selecting a mortgage brokerage is a big choice and this directly influences your business of buying a home. The following are some of the useful considerations that you should take into consideration when choosing the appropriate broker to use:

Skills and Experience

The length of time a broker has in the market will have a significant implication in as far as they will be in a position to get you the best loan. It is quite natural that experienced brokers have connections with lenders that enable them to offer you exciting rates.

Comparison Tools For Loans

Most mortgage brokers have loan comparison services on their web pages, which enable you to compare loan products and lenders easily. Such tools will allow you to be aware of the complete range of possible types of solutions to your problem, without which it is impossible to make a quality decision.

Mortgage Protection Insurance

Although this is not always essential, mortgage protection insurance can offer one a piece of mind in case something happens financially to challenge them. Other mortgage brokers also assist you in selecting the most appropriate mortgage protection insurance that will protect your investment.

Internet Mortgage Applications

Several mortgage brokers are now doing online processing of mortgages, making it convenient for clients who will apply for mortgages by sitting in the comfort of their homes. This aspect will be very useful when it comes to busy people or people who work in remote locations.

Comparison Table: Loan Types Offered by Mortgage Brokers

| Loan Type | Interest Rates | Best For | Key Features |

| Fixed-Rate Mortgages | Set for the term | Stability for long-term borrowers | Predictable payments, long-term security |

| Variable-Rate Mortgages | Fluctuates with market | Those who can manage rate changes | Lower initial rates, potential for savings |

| Low-Doc Home Loans | Higher rates | Self-employed buyers with non-standard income documentation | Easier approval, less documentation required |

| Debt Consolidation Loans | Often lower than current debt rates | Those with multiple high-interest debts | Lower monthly payments, streamline finances |

| Bridging Finance | Varies | Buyers between property sales | Short-term funding for property transitions |

Selecting The Appropriate Mortgage Broker That Serves Your Requirements

The process of choosing the right mortgage broker goes hand in hand with an easy process of buying a home. Some of the things to pay attention to include experience, reputation, services you can offer, and customer support. Be it’s investment property loans or a first-time homebuyer assistance, the right broker will assist you in traversing this procedure with a lot of ease.

You can make educated choices by knowing your choices, leveraging the use of comparison tools, and finding a mortgage broker organization that has the knowledge and drive to help you make an educated decision.

Decision: What A Mortgage Broker Can Do to Empower Your Financial Journey

Mortgage brokerage is also one of the most convenient methods of home loan. Whether you have a home loan or need to refinance, brokers will offer all kinds of services and loans that can suit your specific requirements. When you are serious about making a step forward in your house-buying adventure, remember to trust a professional in the field of a mortgage broker to guide the way towards a better deal.

Amplify Practice only acts in the best interest of helping Australians to have the best home loan rates and solutions. Get in touch with us today to know more about how we can help you with your entire mortgage broker requirements.